Watch Maxed Out For Free

Maxed Out

Maxed Out takes us on a journey deep inside the American debt-style, where everything seems okay as long as the minimum monthly payment arrives on time. Sure, most of us may have that sinking feeling that something isn't quite right, but we're told not to worry. After all, there's always more credit!

| Release : | 2006 |

| Rating : | 7.2 |

| Studio : | |

| Crew : | Director, Writer, |

| Cast : | Louis C.K. |

| Genre : | Documentary |

Watch Trailer

Cast List

Related Movies

The Pursuit of Happyness

The Pursuit of Happyness

The Tailor of Panama

The Tailor of Panama

Batman & Robin

Batman & Robin

The Edukators

The Edukators

Roger & Me

Roger & Me

Black Cat, White Cat

Black Cat, White Cat

Dancer in the Dark

Dancer in the Dark

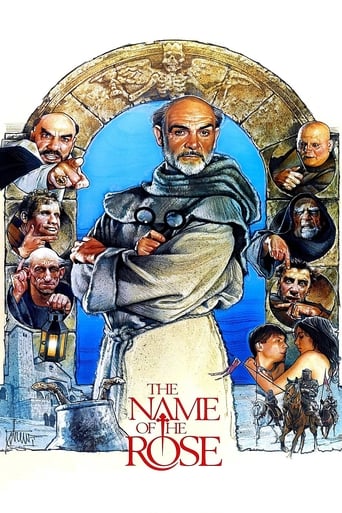

The Name of the Rose

The Name of the Rose

California Winter

California Winter

Reviews

Really Surprised!

This is a tender, generous movie that likes its characters and presents them as real people, full of flaws and strengths.

Easily the biggest piece of Right wing non sense propaganda I ever saw.

An old-fashioned movie made with new-fashioned finesse.

This is more of a documentary than a movie in that it looks at the debt problem that faces the United States, both in a national sense and a personal sense. One of the major things that I see from the documentary (and others like it) is that the national debt in many cases reflects personal debt. The United States as a superpower (and like many superpowers in the past, and no doubt into the future) is a superpower that is built on debt. In many cases superpowers reach their status by being creditor nations, however it seems that in many cases the turning point is when they go from being a net lender to a net borrower, and I suspect that that is the point when the superpower's days are numbered.In many cases the government can be a role-model for the people. Okay, granted, many people hate and distrust the government, and that is to be expected. People want to be free from interference in their lives, and the one thing that governments do, and do well, is interfere. However, what my point is is that if a government openly borrows and gets itself into debt, then the people are going to see that that is something that is okay to do themselves, and thus they are also going to use credit to support their goals and lifestyle. The major difference is that a government can survive (and even inflate away) the debt, whereas individuals cannot (though bankruptcy may be open to them, as this movie shows, even that has been stripped away).I guess the most disturbing thing about this documentary is how epidemic this debt problem is, and that the creditors actively target people who cannot, and will never be able to, pay back the debt. The banks do not make money out of simply the interest, but rather the fees and charges that they incur. In many cases the debt will never be paid back, and the banks don't care because they have already got the principle back, having packaged the loan and onsold it to other financial institutions. In the end this bad debts have been mixed up with good debts, and then flogged off the the pension funds. In a way the banks don't even see the interest, because that is also passed on to the pension funds. In a way, the people are being fleeced both ways, one way in forcing debt onto them, and the second way by simply replacing their life savings with IOUs that will never be paid back (in the same way that the Social Security fund of the United States has been replaced with IOUs).What is really sad is that the main targets are people who are not financially wise. That would have been me back in my 20s. Fortunately in Australia we have strict laws that prevent people who cannot pay back debt from getting into debt. This does not seem to be the case in the United States because it seems that the credit card companies flock to the universities to foist debt onto the students. The theory is that these people will be leaving university and getting good jobs, and thus in the future being able to pay it back. The catch is that through these years at university (particularly with their uni debt onto of everything) they are incurring more and more debt that they cannot afford to repay. In this film there is the sad story of two university students that go so far into debt that the only way out was to kill themselves (and I am surprised that there was no guarantors that the banks would then pursue to get the money back – in fact the other very surprising thing is that after a suicide, the survivors themselves were not being hounded – that would be what would happen here in Australia).However, this documentary was made in 2006, and three years later the whole edifice collapsed. If I had watched this back when it was made I wouldn't have known about the securities and financial magic that the banks used to get their principle back, but as with every financial work of magic, it all turns out to be little more than smoke and mirrors, and in the end the whole edifice came crashing down in 2008.

While watching MAXED OUT, I got very angry - and, not at who most would think.I was angry at the people who maxed out - the people who 'bought' things (I put it in parentheses, as, anything that was purchased on credit wasn't actually owned by the buyer) way over what they could afford.A big problem with (American) society today, is since World War 2, the generations who have grown up, have not had to scrimp, and save. They didn't know what it meant to live during the Depression, when a lot of people lost everything.The plastic cash industry has removed the obstacles, and, deadened people's understanding of the value of things.I wished the film-makers had waited two years (the documentary came out in '06) - after the financial meltdown of '08. It would've added (much!) more fuel to this story.The film makers 'dumbed down' the story into the 'villains' (credit card industry), and, the 'victims/heroes' (American public, by in large), without really among up the fact that no one forces anyone to USE credit cards.They give some attention to saying that people need to take RESPONSIBILITY for themselves, with some clips from Suzy Orman, and such, but, for the. But for the most part, the people portrayed, are 'helpless victims.'A simple lesson most people don't realise, in this consumerist society, is: how do you think someone who has made huge amounts of money (and keeps it) does it? Let me make it clearer: (as an example) you'd never look at Bill Gates, and say; 'he looks like a billionaire.' he looks like... a nerd. Why?Because, he knows that it's not the dollar amount of things you have. I.e.; a pair of Keds will do the same thing as a pair of $200 Nikes. In other words, people are trying to have the APPEARANCE of wealth, and are missing the fact that, you need to WORK, and SAVE - NOT run out and buy something for it's supposed status.The credit industry - as any other industry - has one thing at it's heart: make MORE money, so, I can't fault them for doing what they do. No one 'makes' anyone 'get' a credit card (and, yes, you can live with credit, but, only of you use it prudently).People actually lived before them, and, when they had that tangible grasp on money, they lived within their means. It's the responsibility (a lot of people have trouble doing that) of each person to live within their means.And, with parents giving their kids whatever they want - including credit cards(?!?!), this generation is even LESS connected than their parents were.I say to people not jokingly, that World War 3 was already fought, and America lost, without a single weapon being used.How? To whom did we lose? The United States debt - thanks to that idiot Bush - has ballooned to the largest levels ever (and, say what you want abut Clinton, but, he paid off our debt). Who do you think we owe?The number one country? China.With our willingness to 'sign on the dotted line,' we owe China TRILLIONS. I'm not going to even discuss here how we've 'given' China our once tightly controlled high technology, for the purpose of being the manufacturing country de jour.I wish that people who see MAXED OUT will make their children watch it, as well. They will become the ones this generation has stuck with the bill.

The credit card companies have been maxing out people for decades. In this documentary, it looks at it's predatory lending policies especially towards college students on campus. The credit cards were always meant as a safety net or if you didn't have money. Some people used their credit cards as life support in emergency situations. Our financial situation in this country has further deteriorated since this documentary. You don't have to watch Michael Moore's film to see the situation's effect. Armed bank robbers are less deadly than the bank robbers in suits and ties who walk in on Wall Street. They may not have guns but they have the access and ability to destroy our economic situation far more than armed bank robbers like Bonnie and Clyde etc. Bank robberies don't happen like that anymore. It's done on the internet or in the policy meetings. The people you meet in this documentary are real and authentic. Debt has driven people to commit suicide because of the harassing phone calls and letters threatening to take away. That's the bottom dollar. Are the creditors far more interested in driving people to commit suicide or lose their sanity than get the money? It's a shame that it's going on and that people will be in debt until their dead. It's a perverted kind of freedom to be in debt like having a noose around your neck and the debt gets bigger than smaller with rising interest rates, penalties, and no breaks. Whatever happened to compassion and mercy in this society?

The collection strategies used by collection companies, some of which are illustrated in "Maxed Out," are unsavory by any measure and can't be gainsaid. Nevertheless, the film seems not to know the meaning of the term "Personal responsibility." The folks who get into the kinds of trouble depicted by the movie got there because they lived beyond their means, the difference between their income and outgo being financed by credit card companies, albeit at outrageous rates. Still, the debtors either knew or should have known what they were getting into.I agree, though, with the film's depiction of The Bankruptcy Reform Act of 2005. The act was not really a "reform," but a limitation of the rights formerly provided to debtors to discharge their debts in bankruptcy. Even under the old law, nobody who wasn't desperate sought bankruptcy protection. To narrow its protections was an outrage, it seems to me.Despite its propagandistic tone, one-sidedness, and anti-business attitudes, "Maxed Out" is occasionally informative and makes some useful points. Marginally recommended if you have some stomach medicine nearby.